Regions

Contact Information

Company Details

Location Type: Branch

Industry: National Commercial Banks

Ownership: Public

Year Founded: 1971

Sales Range: $5,000,000,000 to $9,999,999,999

Employees: 10,000 to 25,000

Is This Your Customer, Supplier, Or Partner?

Is This Your Business?

Is This Your Customer, Supplier, Or Partner?

Pull Their Credit Report CREATE A FREE ACCOUNT

Company Credit Alerts

Recent Alerts

Credit Risk Increase

No

Overall Payments

No

Bankruptcy

No

Tax Liens

No

UCC Filings

No

Company Payment Insights

Risk of Severe Delinquency

See this company's likelihood of paying its bills in a severely delinquent manner (90+ days late) in the next 12 months.

Company News

Latest News

Bill Rhodes appointed to Boards of Directors of Regions Bank, Regions Financial Corp.

The Birmingham News - Birmingham, AL

Apr 16 2024

Regions reports $2 billion in net income

The Birmingham Business Journal

Mar 4 2024

Former AutoZone CEO named to Regions board

Bizjournals Banking and Financial

Feb 15 2024

Ascentium Capital offers equipment financing options

Overview of New Woodworking Tools and Technology | Woodshop News

Jan 2 2024

Regions Bank names new Pinellas market executive after leadership shuffle

Bizjournals Human Resources

Dec 7 2023

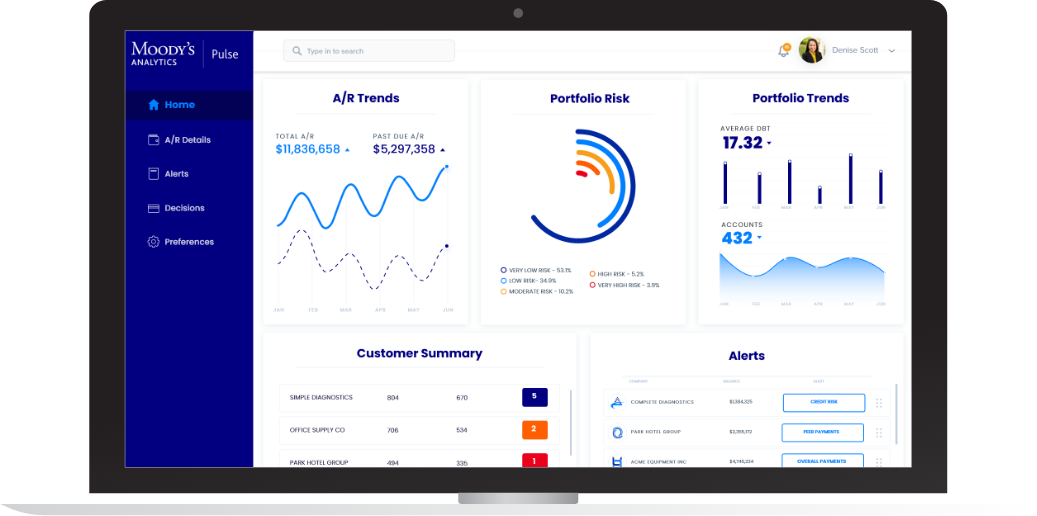

Analyze Your Entire AR Portfolio with One Free Credit Tool

LEARN MORECompany Buying Behavior

Overall Company Spend

Company Spend by Category

Material Spend

ONE YEAR GROWTH

Operations Spend

ONE YEAR GROWTH

Shipping Spend

ONE YEAR GROWTH

See this company's YOY change in purchases for each major spend category and learn the business implications of those changes.

BUY CREDIT REPORTCredit Analysis Tip

Purchases of key products and services provides insight into whether a business is growing or declining financially. Analyzing spending enables creditors predict risk scenarios before other credit analysis methods. Lean how in our latest case study.

DOWNLOAD CASE STUDYCompany Credit Alerts

Recent Alerts

Credit Risk Increase

No

Overall Payments

No

Bankruptcy

No

Tax Liens

No

UCC Filings

No

Sales Insights

More Businesses Like this

Discover other companies in the same industry you can sell to: